This continues my thread on human thermal response and performance, a topic of interest because it offers flexibility in dealing with thermal inflation, energy use, and global warming. A word of warning as you read this post. The person I interviewed is in outstanding shape and knows exactly what he is doing, having done it for years. If one is going to try it, it makes sense to approach it a little bit at a time, and bring along backup protection. One of the things that prevents me from moving my experiments in this direction is recognition that, even if I might do fine in the first mile, I might have a problem in the second mile, and not be able to get back safely home.

February 28, 2009. On the way riding my bicycle back from the library this morning, I happened to see a man running in runner's shorts and shoes, athletic socks, and gloves. His top and legs were exposed to the elements. After a brief consideration about whether to reach out to him, I caught up to him on the left side of Route 20 going in toward Boston, and rode along with him about a half mile. At first he was a little reluctant to talk because, he said, a lot of people think he is nuts. I did not think he was nuts at all, and the conversation I had with him indicated he was certainly not nuts, unless all marathoners are nuts, which some might argue is true. To me this is further validation of my theory about thermal inflation, a topic about which I posted earlier this year, and have written about since 1979.

He explained that he was out on his "long route," 17 miles, in preparation for the Boston Marathon which is not so many weeks from now. The other striking things about him were his age and the way he bent his knees to cushion his body from the shocks of running on pavement. He explained that he had started his experiment with temperature about 40 years ago. At first he had run during winter in heavy clothing and had sweat profusely. Then he realized that this did not make a lot of sense, so he started experimenting with varying levels of clothing, obviously less and less.

What he had learned was that the body generates a lot of heat, which is a disadvantage in excess, and which is retained more if you do not start sweating. He also learned, as he put it, that the pores in one's skin shut down if the skin is exposed to the cold. Much as I have found in my experiments, he found that one can "fool" oneself about how warm or cold one is, by focusing on the perceived temperature of one's skin. What counts is the internal temperature. So after being something of a wimp about the cold when he was a boy, he had to work his way through his expectations and beliefs about his skin being cold. Those cold sensations are good rather than bad.

Also an important factor is never to sweat, because when the sweating begins the skin temperature and body temperature become regulated in a very different way. This modifies the skin barrier between the elements and the core of the body. He commented that he had learned about a remarkable woman who swam competitively in cold bodies of water such as the English Channel, without a wet suit or grease to provide thermal insulation for her body. Her body had adapted by developing a layer of thick subcutaneous fat that serves as that layer of insulation. Indeed, the human body is able to adapt in all kinds of interesting ways, if we foster its doing so!

Then we got to the gloves. I explained that I live at 45-52 degrees, and that when I start to get cold, the first sign is that my hands get cold. He exclaimed, "Yes," the same thing happens for him. This is the reason that he runs with thick winter gloves on his hands.

More later after I get the chance to interview this insightful man who has been willing to experiment for decades.

Saturday, February 28, 2009

Monday, February 23, 2009

Does Algae Plus Wind Power Equal Biofuel

Use of algae for generating fuel is one of the leading edges of thinking about alternative energy. Some of the benefits and problems have been pointed out in other comments at the New York Times (http://greeninc.blogs.nytimes.com/2009/02/23/does-algae-plus-wind-power-equal-biofuel/). I have been on the roof of the MIT co-generation plant, where there is a small-scale pilot algae project for extracting CO2 from exhaust. Because I was there on an overcast wintry day, I saw it at a time when I would be skeptical that production would be very high or that very much CO2 would be extracted. On the other hand, production and extraction should be quite high on a hot summer day when the sun is burning down. One might draw from this that the effectiveness of such approaches would depend on environmental factors, although one might conceive of algae that are very active without much sun. Of course, the warmth can come from the exhaust, but for ocean-based algae will require some other source of heat.

I would be concerned about the fate of these large vats for algae, and possibly for the wind turbine towers to which they are tethered. Those who work with the ocean have universally come to be humbled by its power. It does not take a major storm to destroy ships that are much more seaworthy than any large vat that can be readily designed and built. Their very size makes them very vulnerable. At the same time, indeed, there are better uses for farmland than growing corn for ethanol. Farmers have benefitted financially in important ways from the ethanol initiative. However, there are better ways to offer farmers economic opportunity and fairness in the larger economy. I applaud the willingness of some to invest their private resources to address the challenge and, if it goes to a pilot, will be interested to see how it comes out.

A key bottom line that we approach is one that I have stated to many people over the past two decades. It is fine to live in a world dominated by engineering and science rather than by nature, but we had better know what we are doing. Proposals like this make me nervous that we know enough of what we are doing. At the same time, we need not get too nervous about it, because the ideas have now entered the bright sun of day. Time and effort will determine whether they are realistic.

I would be concerned about the fate of these large vats for algae, and possibly for the wind turbine towers to which they are tethered. Those who work with the ocean have universally come to be humbled by its power. It does not take a major storm to destroy ships that are much more seaworthy than any large vat that can be readily designed and built. Their very size makes them very vulnerable. At the same time, indeed, there are better uses for farmland than growing corn for ethanol. Farmers have benefitted financially in important ways from the ethanol initiative. However, there are better ways to offer farmers economic opportunity and fairness in the larger economy. I applaud the willingness of some to invest their private resources to address the challenge and, if it goes to a pilot, will be interested to see how it comes out.

A key bottom line that we approach is one that I have stated to many people over the past two decades. It is fine to live in a world dominated by engineering and science rather than by nature, but we had better know what we are doing. Proposals like this make me nervous that we know enough of what we are doing. At the same time, we need not get too nervous about it, because the ideas have now entered the bright sun of day. Time and effort will determine whether they are realistic.

Saturday, February 21, 2009

China and U.S. Foreign Relations

China poses a key party to coping with the global warming situation. The Obama administration appears to be giving this a significant priority.

http://www.nytimes.com/2009/02/22/world/asia/22diplo.html?_r=1&hp

http://www.nytimes.com/2009/02/22/world/asia/22diplo.html?_r=1&hp

Thursday, February 19, 2009

Barney Frank On the Stimulus and Bail-Out

A functional economy is important for the success of green energy and actions to limit emissions of greenhouse gases into the atmosphere. This is because the economy must be functional if the necessarily resources are to be mobilized in the required direction. Below are my notes of Barney Frank's talk on 2/19/2009. I planned to post some video and audio of the event. It depended on uploading speeds for blogspot, and unfortunately, blogspot flunked all tests for this effort.

7:30 Barney Frank arrives at Scituate High School and walks directly up to a chair and table on the stage, to the strong applause of those assembled. In the notes below, some parts are very detailed because the details were particularly important. Others are not included. For example, there were a lot of lines that led to laughter. Only some are noted.

Intro by Kevin McCarthy, Chair of South Shore Democratic Caucus.

[Two reporters from the Patriot Ledger are present, one whose deadline is at 10 p.m., an hour after the event closes. Captain Lou @ WATD-FM is in favor of the fishermen and does not believe that is a shortage of fish in the fisheries. He is one of three of us in the press section, and he plans to pose his questions to the Congressman after the formal program.]

My notes on the initial speech by Barney Frank:

We are in a period of American history that will be addressed by the history books. Comparable to the New Deal. There are also foreign policy issues, although not of the same magnitude as those that led to World War II.

Partisanship is a good thing as long as it does not become too extreme. Partisanship is means to make the debate more rational. Newt Gingrich tried to change what partisanship is. But Tip O’Neill and Ronald Reagan were friends in the evening. To Gingrich the opposing party were traitors, corrupt rather than honorable people who disagree. Tom Delay continued this. This notion of partisanship should be done away with but not replaced by mere amorphousness. There are very strong differences between the parties today, particularly in economics. [We need to let the partisanship display the differences between the parties, the way they tackle issues, and their results.]

We set up the bank bailout and were told [by the Bush administration] that we could not place restrictions (see also http://www.pbs.org/wgbh/pages/frontline/meltdown/). So we offered them half of the $700B and told them they could not get the other half unless we were satisfied with the way they used the first half. So when it came time for the second half, I told Paulsen that we were not satisfied and that he would not get the second half. Now the Obama administration will be working with the second half, and I think we are going to see the real differences between the parties.

There have been three periods in American history when innovative economic systems have emerged offering a greater degree of efficiency. The problem is that there are no rules to govern such new activity. Late 19th century offered oil, steel. What Roosevelt and Wilson did was to say these were good things, but there need to be rules such as anti-trust. The stock market was the next development and led to the corrections of the New Deal. If there are no rules, the lowest common denominator will win. The next period was “securitization.” This has enabled making bad decisions and then having means to spread it around. In the traditional way, when you get a mortgage, the bank gets its return when you pay it back. And because the bank took all the risk, it frisked you pretty well to make sure you would pay it back. And the banks were regulated, because the government is on the hook if you mess up, and that system has worked pretty well. And then the financial system was working pretty well and there were pools of money available that were not from deposits in banks, so loans became available from other institutions.

And then there was the Community Reinvestment Act in 1977. This affected only banks, not other kinds of institutions. So community banks are justifiably angry when they hear that banks are being blamed, because if only banks had been giving out these loans, we would not have had the subprime crisis, because they didn't make bad loans. Most of the loans that went bad were made by institutions outside the banking system, not covered by the Community Reinvestment Act. So then you ask: What is the point of selling loans to people who can't pay you back? Very simple. You sell the right to be paid back. That is called securitization, which is similar to the stock market. It does a lot of good, but it also does a lot of bad unless you regulate it.

The Conservative view it that it’s the government’s fault. You made the banks loan to poor people. But community banks were not the only ones that had trouble. Most loans that were made to people who could not pay back were from entities not covered by the legislation that called for loans to the poor.

So what is the advantage? You sell the right to be paid back. This is securitization and it spreads risk. If you make a loan and then sell the right to be paid back, then you can make more loans. But you have to be paid back for it to work, so there is also a potential problem here. Most people are much more careful with their own money than with others’ money. So the loan makers were not careful in making loans when they would not have to collect. And then people would sell them and buy them outside the regulated system. This is the problem.

If you think about it, it used to be that advisors would tell you that if you want to be adventurous, you can invest in stock, but if you want to play it safe, you would invest in bonds. But now, it is the reverse because of the new instruments including derivatives.

Securitization is good, but it needs to be regulated. There has been a whole set of activity going on entirely outside of regulation. Democrats believed that you should regulate this area. Alan Greenspan admitted that he had been fundamentally wrong not to regulate when he had the option to do so. In 1994, the last time that the Democrats controlled Congress, we passed legislation that was signed by Bill Clinton. It said that we were concerned about the many mortgages that were being let out by non-bank institutions. Would you please stop these loans from happening. Alan Greenspan said, and it is well established that he did , "No I won't do that. That's regulation and the market knows better than I do." His successor, Ben Bernanke, has issued rules using exactly the same authority and legislation governing his actions.

Then the second thing happened. There was a decision to foster home ownership among many more Americans. My role in this has been asserted, but let's discuss a little. I was one of the few politicians who was saying that helping lower income people to get mortgages is a bad idea, because putting people in a position with homes they cannot manage and loans they cannot pay off is not a good thing. One of the big fights I have had with the Bush Administration is "How do you get lower income people to buy homes." I believe that for many people, decent rental housing is the way to go. I had this argument with the Secretary of HUD for the Bush Administration. He said he was going to cut people off Section 8 for rental assistance after five years. He asked if I would support that, and I said "No." He said, "Why." I said, "What happens to them after five years. I'll support you in cutting them off if you'll support them in not being poor after five years." [extended laughter] So I said "What will happen to these families after five years if we don't help them?" He said, "We will help them become home owners." The problem came in 2004 when the Bush Administration ordered Fannie Mae and Freddie Mac to increase the number of mortgages they bought from people below the median income. Greatly increasing home ownership was going to be their social contribution. When they did that, we became worried, and in 2004-5 a group of us in the House, mostly Democrats but one Republican, frustrated by Alan Greenspan's refusal to use the authority given to him by Congress, tried to pass a law to prevent these subprime mortgages that were being granted. We were in the midst of negotiations when Tom Delay sent word to the chairman of the committee that I served on as a minority member, "Stop it. We're Repubicans. We don't do that." In 2007 when the Democrats won the majority and I became Chairman of the committee, we passed legislation. So the Republicans argue that in 1995 through 2006 when they controlled Congress, I stopped them. [laughter] Unfortunately, after we passed that legislation in the House, the Senate was only 51-49. In summary we had a refusal by the Conservatives to regulate the sub-prime instruments, and then we had a refusal by the Conservatives to regulate the financial instruments which packaged up those instruments and sold them all over the world. We are now in a difficult situation that we hope to get out of. I do believe the Economic Recovery Plan will be helpful. What President Obama did yesterday will be helpful.

We need to do things that make for transparency and foster trust. The person who is elected President in 2012 will be required to check with the analysis of the Congressional Budget Office to find out how much of the $700B has been recovered. If all of it has been recovered, fine. If not, then he is mandated by law to make a proposal to Congress as to how to get the shortfall back by taxes and fees from the financial industry, the industry that benefitted. Unless there are greater changes than I anticipate, I guarantee you that the Congress that is in power in 2013 will not say, "Oh no Mr. President. These nice people don't need to pay that. Let's have the American taxpayers pay that instead."

There are three things the Obama Administration is doing. We know how to make sure this does not happen again. The first is by regulation, sensible regulation. The right kind of regulation is pro-market. Investors bought all this securitized junk. When people touch the hot stove, they refuse to touch it again, and sometimes they refuse also to touch the refrigerator, the sink, the table, and a lot of other things. [laughter] We need to get people back from refusing to touch the stove again after being burned. Prevent loans from being given out to people who should not be getting loans. 2nd, when it comes to securitization, you cannot sell 100% of the right to be paid. Must keep 15% to 20% of the risk. We want these institutions to keep what some people call “skin” in the game. This is like in the insurance industry with respect to reinsurance. 3rd we will regulate the extent to which people can get themselves in debt. It will cover all types of businesses. If you regulate by type of business, pretty soon there will be a new type of business invented that is outside regulation. The idea is to prevent institutions to get so in debt that you could default leading to extensive collateral damage. One example of this is credit default swaps, which are really a form of insurance. I issue a credit default swap to you guaranteeing that your collateralized debt obligation derivative won't default. Usually, by the way, if you want to insure somebody, you have to have an insurable interest. You can't just go out and insure some stranger's life. [laughter] And you have to be able to show the regulator that you have the ability to pay off your insurance claims by some combination of your own capital and reinsurance. In the past the assumption was that these things would never default. It's kind of like you decided to go into the life insurance business issuing policies on vampires [laughter] and then the vampires started dying [more laughter]. That by the way, is why doing something about foreclosure is so important, because as the assets value deteriorates, a lot of people are in position to make payments that they cannot pay. We do want to slow that down. I should add, it was never the case that we should have stopped house prices from dropping in an orderly way. Housing prices had gotten to be too high. It's like, I'd like to lose 20 pounds, but not by Sunday. [laughter]

So we know what to do going forward. It was not deregulation but non-regulation that caused our problems. It is just like to twenties, and then Roosevelt established regulations for stocks.

Don’t be protectionist is what some people say. The average American is justifiably so angry at the unfairness of the way that the economy has worked: during the good times almost all the wealth went to a small handful of people. Trade helps the overall economy, but it does it in an uneven way. People with high end jobs make most of the money when there is trade. Warren Buffet: we have class warfare in America. My class is winning. [laughter] We need to maintain a safety net. What will reduce the resistance to free trade? I'll give you the most important thing. We need a system where people do not lose their healthcare when they loose their jobs. Stop fighting unions, which now turn out to have been a very useful thing. Put money into things like the community college system where people to develop skills for jobs.

And finally, some will ask where do you get the money for all of this? I was in Congress in September 10, 2001. I guarantee you that there was no money in the budget for a war in Iraq. Since that time we have found over $700B for a war in Iraq, and even though Obama is going to wind it down, it will get close to a trillion for now. When it comes time to find the money for better health care, education, and these things, I am going to go to the guy in Congress who found $700B for the War in Iraq, and $700B for the bail-out if he can find some. This is a very rich society. If we set our minds correctly to priorities, we can treat ourselves better than we have been treating ourselves.

Barney Frank talks on February 19, 2009 in constituent town meeting about the bank bailout. It starts with discussion of the actions of Bush's Secretary of the Treasury in giving $350B to large banks, and the reaction to that.

http://www.youtube.com/watch?v=ZsOZuE6s5P0

on banks and non-banks:

http://www.youtube.com/watch?v=3xQ8KNNRi5o

on credit card practices:

http://www.youtube.com/watch?v=2WJCpxyqsZU

These three videos provide a pretty good taste of what the event was like. They complement the text above.

7:30 Barney Frank arrives at Scituate High School and walks directly up to a chair and table on the stage, to the strong applause of those assembled. In the notes below, some parts are very detailed because the details were particularly important. Others are not included. For example, there were a lot of lines that led to laughter. Only some are noted.

Intro by Kevin McCarthy, Chair of South Shore Democratic Caucus.

[Two reporters from the Patriot Ledger are present, one whose deadline is at 10 p.m., an hour after the event closes. Captain Lou @ WATD-FM is in favor of the fishermen and does not believe that is a shortage of fish in the fisheries. He is one of three of us in the press section, and he plans to pose his questions to the Congressman after the formal program.]

My notes on the initial speech by Barney Frank:

We are in a period of American history that will be addressed by the history books. Comparable to the New Deal. There are also foreign policy issues, although not of the same magnitude as those that led to World War II.

Partisanship is a good thing as long as it does not become too extreme. Partisanship is means to make the debate more rational. Newt Gingrich tried to change what partisanship is. But Tip O’Neill and Ronald Reagan were friends in the evening. To Gingrich the opposing party were traitors, corrupt rather than honorable people who disagree. Tom Delay continued this. This notion of partisanship should be done away with but not replaced by mere amorphousness. There are very strong differences between the parties today, particularly in economics. [We need to let the partisanship display the differences between the parties, the way they tackle issues, and their results.]

We set up the bank bailout and were told [by the Bush administration] that we could not place restrictions (see also http://www.pbs.org/wgbh/pages/frontline/meltdown/). So we offered them half of the $700B and told them they could not get the other half unless we were satisfied with the way they used the first half. So when it came time for the second half, I told Paulsen that we were not satisfied and that he would not get the second half. Now the Obama administration will be working with the second half, and I think we are going to see the real differences between the parties.

There have been three periods in American history when innovative economic systems have emerged offering a greater degree of efficiency. The problem is that there are no rules to govern such new activity. Late 19th century offered oil, steel. What Roosevelt and Wilson did was to say these were good things, but there need to be rules such as anti-trust. The stock market was the next development and led to the corrections of the New Deal. If there are no rules, the lowest common denominator will win. The next period was “securitization.” This has enabled making bad decisions and then having means to spread it around. In the traditional way, when you get a mortgage, the bank gets its return when you pay it back. And because the bank took all the risk, it frisked you pretty well to make sure you would pay it back. And the banks were regulated, because the government is on the hook if you mess up, and that system has worked pretty well. And then the financial system was working pretty well and there were pools of money available that were not from deposits in banks, so loans became available from other institutions.

And then there was the Community Reinvestment Act in 1977. This affected only banks, not other kinds of institutions. So community banks are justifiably angry when they hear that banks are being blamed, because if only banks had been giving out these loans, we would not have had the subprime crisis, because they didn't make bad loans. Most of the loans that went bad were made by institutions outside the banking system, not covered by the Community Reinvestment Act. So then you ask: What is the point of selling loans to people who can't pay you back? Very simple. You sell the right to be paid back. That is called securitization, which is similar to the stock market. It does a lot of good, but it also does a lot of bad unless you regulate it.

The Conservative view it that it’s the government’s fault. You made the banks loan to poor people. But community banks were not the only ones that had trouble. Most loans that were made to people who could not pay back were from entities not covered by the legislation that called for loans to the poor.

So what is the advantage? You sell the right to be paid back. This is securitization and it spreads risk. If you make a loan and then sell the right to be paid back, then you can make more loans. But you have to be paid back for it to work, so there is also a potential problem here. Most people are much more careful with their own money than with others’ money. So the loan makers were not careful in making loans when they would not have to collect. And then people would sell them and buy them outside the regulated system. This is the problem.

If you think about it, it used to be that advisors would tell you that if you want to be adventurous, you can invest in stock, but if you want to play it safe, you would invest in bonds. But now, it is the reverse because of the new instruments including derivatives.

Securitization is good, but it needs to be regulated. There has been a whole set of activity going on entirely outside of regulation. Democrats believed that you should regulate this area. Alan Greenspan admitted that he had been fundamentally wrong not to regulate when he had the option to do so. In 1994, the last time that the Democrats controlled Congress, we passed legislation that was signed by Bill Clinton. It said that we were concerned about the many mortgages that were being let out by non-bank institutions. Would you please stop these loans from happening. Alan Greenspan said, and it is well established that he did , "No I won't do that. That's regulation and the market knows better than I do." His successor, Ben Bernanke, has issued rules using exactly the same authority and legislation governing his actions.

Then the second thing happened. There was a decision to foster home ownership among many more Americans. My role in this has been asserted, but let's discuss a little. I was one of the few politicians who was saying that helping lower income people to get mortgages is a bad idea, because putting people in a position with homes they cannot manage and loans they cannot pay off is not a good thing. One of the big fights I have had with the Bush Administration is "How do you get lower income people to buy homes." I believe that for many people, decent rental housing is the way to go. I had this argument with the Secretary of HUD for the Bush Administration. He said he was going to cut people off Section 8 for rental assistance after five years. He asked if I would support that, and I said "No." He said, "Why." I said, "What happens to them after five years. I'll support you in cutting them off if you'll support them in not being poor after five years." [extended laughter] So I said "What will happen to these families after five years if we don't help them?" He said, "We will help them become home owners." The problem came in 2004 when the Bush Administration ordered Fannie Mae and Freddie Mac to increase the number of mortgages they bought from people below the median income. Greatly increasing home ownership was going to be their social contribution. When they did that, we became worried, and in 2004-5 a group of us in the House, mostly Democrats but one Republican, frustrated by Alan Greenspan's refusal to use the authority given to him by Congress, tried to pass a law to prevent these subprime mortgages that were being granted. We were in the midst of negotiations when Tom Delay sent word to the chairman of the committee that I served on as a minority member, "Stop it. We're Repubicans. We don't do that." In 2007 when the Democrats won the majority and I became Chairman of the committee, we passed legislation. So the Republicans argue that in 1995 through 2006 when they controlled Congress, I stopped them. [laughter] Unfortunately, after we passed that legislation in the House, the Senate was only 51-49. In summary we had a refusal by the Conservatives to regulate the sub-prime instruments, and then we had a refusal by the Conservatives to regulate the financial instruments which packaged up those instruments and sold them all over the world. We are now in a difficult situation that we hope to get out of. I do believe the Economic Recovery Plan will be helpful. What President Obama did yesterday will be helpful.

We need to do things that make for transparency and foster trust. The person who is elected President in 2012 will be required to check with the analysis of the Congressional Budget Office to find out how much of the $700B has been recovered. If all of it has been recovered, fine. If not, then he is mandated by law to make a proposal to Congress as to how to get the shortfall back by taxes and fees from the financial industry, the industry that benefitted. Unless there are greater changes than I anticipate, I guarantee you that the Congress that is in power in 2013 will not say, "Oh no Mr. President. These nice people don't need to pay that. Let's have the American taxpayers pay that instead."

There are three things the Obama Administration is doing. We know how to make sure this does not happen again. The first is by regulation, sensible regulation. The right kind of regulation is pro-market. Investors bought all this securitized junk. When people touch the hot stove, they refuse to touch it again, and sometimes they refuse also to touch the refrigerator, the sink, the table, and a lot of other things. [laughter] We need to get people back from refusing to touch the stove again after being burned. Prevent loans from being given out to people who should not be getting loans. 2nd, when it comes to securitization, you cannot sell 100% of the right to be paid. Must keep 15% to 20% of the risk. We want these institutions to keep what some people call “skin” in the game. This is like in the insurance industry with respect to reinsurance. 3rd we will regulate the extent to which people can get themselves in debt. It will cover all types of businesses. If you regulate by type of business, pretty soon there will be a new type of business invented that is outside regulation. The idea is to prevent institutions to get so in debt that you could default leading to extensive collateral damage. One example of this is credit default swaps, which are really a form of insurance. I issue a credit default swap to you guaranteeing that your collateralized debt obligation derivative won't default. Usually, by the way, if you want to insure somebody, you have to have an insurable interest. You can't just go out and insure some stranger's life. [laughter] And you have to be able to show the regulator that you have the ability to pay off your insurance claims by some combination of your own capital and reinsurance. In the past the assumption was that these things would never default. It's kind of like you decided to go into the life insurance business issuing policies on vampires [laughter] and then the vampires started dying [more laughter]. That by the way, is why doing something about foreclosure is so important, because as the assets value deteriorates, a lot of people are in position to make payments that they cannot pay. We do want to slow that down. I should add, it was never the case that we should have stopped house prices from dropping in an orderly way. Housing prices had gotten to be too high. It's like, I'd like to lose 20 pounds, but not by Sunday. [laughter]

So we know what to do going forward. It was not deregulation but non-regulation that caused our problems. It is just like to twenties, and then Roosevelt established regulations for stocks.

Don’t be protectionist is what some people say. The average American is justifiably so angry at the unfairness of the way that the economy has worked: during the good times almost all the wealth went to a small handful of people. Trade helps the overall economy, but it does it in an uneven way. People with high end jobs make most of the money when there is trade. Warren Buffet: we have class warfare in America. My class is winning. [laughter] We need to maintain a safety net. What will reduce the resistance to free trade? I'll give you the most important thing. We need a system where people do not lose their healthcare when they loose their jobs. Stop fighting unions, which now turn out to have been a very useful thing. Put money into things like the community college system where people to develop skills for jobs.

And finally, some will ask where do you get the money for all of this? I was in Congress in September 10, 2001. I guarantee you that there was no money in the budget for a war in Iraq. Since that time we have found over $700B for a war in Iraq, and even though Obama is going to wind it down, it will get close to a trillion for now. When it comes time to find the money for better health care, education, and these things, I am going to go to the guy in Congress who found $700B for the War in Iraq, and $700B for the bail-out if he can find some. This is a very rich society. If we set our minds correctly to priorities, we can treat ourselves better than we have been treating ourselves.

Barney Frank talks on February 19, 2009 in constituent town meeting about the bank bailout. It starts with discussion of the actions of Bush's Secretary of the Treasury in giving $350B to large banks, and the reaction to that.

http://www.youtube.com/watch?v=ZsOZuE6s5P0

on banks and non-banks:

http://www.youtube.com/watch?v=3xQ8KNNRi5o

on credit card practices:

http://www.youtube.com/watch?v=2WJCpxyqsZU

These three videos provide a pretty good taste of what the event was like. They complement the text above.

Monday, February 16, 2009

Moratorium on Coal Plants?

From what I understand of James Hansen's work, and the implications as spelled out in earlier posts on this blog, our society and the entire world, must have a moratorium on coal plants starting now. I have not personally taken a position on that question because I recognize that forbearance can be a very important virtue as long as we move efficiently and rapidly toward reducing our overall carbon footprint. But as lawyers sometimes like to say, time is of the essence.

This from the New York Times: This green chorus also includes Al Gore, the former vice president, Eric E. Schmidt, the chief executive of Google, and Harry Reid, the Senate majority leader, who has called for a moratorium on new coal plants.

Is America Ready to Quit Coal?

http://www.nytimes.com/2009/02/15/business/15coal.html

Also possibly of interest in the article is the appearance of The Rising Tide, which made an appearance at the Harvard talk given by Steven Leer of Arch Coal. Here is the best picture I captured of that protest demonstration from my vantage point in the middle of the audience. The same New York Times article has this about their protest of Duke Energy's proposed coal-fired power plant:

Last May, protesters took over James E. Rogers’s front lawn in Charlotte, N.C., unfurling banners declaring “No new coal” and erecting a makeshift “green power plant” — which, they said in a press release, was fueled by “the previously unexplored energy source known as hot air, which has been found in large concentrations” at his home. And so it goes for Mr. Rogers, the chief executive of Duke Energy. For three years, environmentalists have been battling to stop his company from building a large coal-fired power plant in southwestern North Carolina.

battling to stop his company from building a large coal-fired power plant in southwestern North Carolina.

The interesting things about the Rising Tide demonstrations is that they are in at least two different geographical regions, and that they were both apparently very well planned. (You cannot set up shop on the front lawn of a CEO of a major company and have it witnessed without some skillful preparation.) See Natasha Whitney's article about the event in the Harvard Crimson (http://www.thecrimson.com/article.aspx?ref=526312). See the YouTube entry (http://www.youtube.com/watch?v=j-gaTWBptKE) for the Rising Tide video of the Harvard demonstration. The camera angle is excellent, the result of careful planning. The demonstration triggered during the time that a person from Rising Tide in the audience was asking some challenging questions. As a member of the audience, I was completely suprised when the demonstration suddenly unfolded. And when Dan Schrag of Harvard stood up to interrupt the demonstration and confront the questioner, the demonstrators folded their cards quickly and without dispute. Of course, the real deal is the influence of the YouTube video, and capturing that video is something that the protesters had already achieved. It was captioned and put up on YouTube in significantly less than 24 hours, further evidence of how well planned and executed the protest really was.

This from the New York Times: This green chorus also includes Al Gore, the former vice president, Eric E. Schmidt, the chief executive of Google, and Harry Reid, the Senate majority leader, who has called for a moratorium on new coal plants.

Is America Ready to Quit Coal?

http://www.nytimes.com/2009/02/15/business/15coal.html

Also possibly of interest in the article is the appearance of The Rising Tide, which made an appearance at the Harvard talk given by Steven Leer of Arch Coal. Here is the best picture I captured of that protest demonstration from my vantage point in the middle of the audience. The same New York Times article has this about their protest of Duke Energy's proposed coal-fired power plant:

Last May, protesters took over James E. Rogers’s front lawn in Charlotte, N.C., unfurling banners declaring “No new coal” and erecting a makeshift “green power plant” — which, they said in a press release, was fueled by “the previously unexplored energy source known as hot air, which has been found in large concentrations” at his home. And so it goes for Mr. Rogers, the chief executive of Duke Energy. For three years, environmentalists have been

battling to stop his company from building a large coal-fired power plant in southwestern North Carolina.

battling to stop his company from building a large coal-fired power plant in southwestern North Carolina.The interesting things about the Rising Tide demonstrations is that they are in at least two different geographical regions, and that they were both apparently very well planned. (You cannot set up shop on the front lawn of a CEO of a major company and have it witnessed without some skillful preparation.) See Natasha Whitney's article about the event in the Harvard Crimson (http://www.thecrimson.com/article.aspx?ref=526312). See the YouTube entry (http://www.youtube.com/watch?v=j-gaTWBptKE) for the Rising Tide video of the Harvard demonstration. The camera angle is excellent, the result of careful planning. The demonstration triggered during the time that a person from Rising Tide in the audience was asking some challenging questions. As a member of the audience, I was completely suprised when the demonstration suddenly unfolded. And when Dan Schrag of Harvard stood up to interrupt the demonstration and confront the questioner, the demonstrators folded their cards quickly and without dispute. Of course, the real deal is the influence of the YouTube video, and capturing that video is something that the protesters had already achieved. It was captioned and put up on YouTube in significantly less than 24 hours, further evidence of how well planned and executed the protest really was.

Saturday, February 14, 2009

Changes in Patent Situation After Some Major Recent Decisions

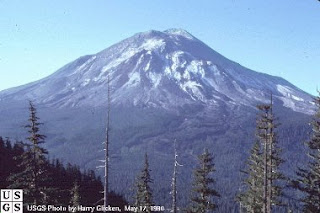

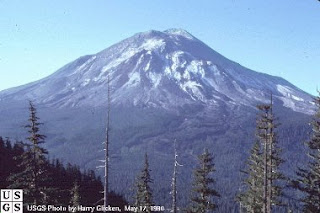

The American Bar Association Midyear Meeting has been held February 11-17 in  Boston. On Saturday, February 14 2009, afternoon panels led by Phil Swain and Marc Temin of Foley Hoag addressed new developments in the ways that patents can be invalidated. This represents an emerging critical dysfunction in the patent and litigation system. One speaker, Jerry Riedinger, likened recent developments re summary judgement in the case KSR International Co. v. Teleflex Inc. to the explosion of Mt. St. Helen. It was common knowledge that something was brewing, and then the mountain blew, creating a large, ugly hole. (Image from http://www.olywa.net/radu/valerie/StHelens.html.) The material addressed by

Boston. On Saturday, February 14 2009, afternoon panels led by Phil Swain and Marc Temin of Foley Hoag addressed new developments in the ways that patents can be invalidated. This represents an emerging critical dysfunction in the patent and litigation system. One speaker, Jerry Riedinger, likened recent developments re summary judgement in the case KSR International Co. v. Teleflex Inc. to the explosion of Mt. St. Helen. It was common knowledge that something was brewing, and then the mountain blew, creating a large, ugly hole. (Image from http://www.olywa.net/radu/valerie/StHelens.html.) The material addressed by  this panel is critically important for green-ness because the shift to the new ways will require an immense amount of innovation. It is well known that a lot of the breakthrough innovation comes out of university research and small business. In the best world this grows into large companies or is merged with larger companies, leading to large scale commercialization. For this process to work successfully, it is critical that patent protection be effective. If the patent and courts systems are broken, there will not be a proper incentive for innovators, commercializers, or investors to proceed. Instead the coupon clippers will prevail.

this panel is critically important for green-ness because the shift to the new ways will require an immense amount of innovation. It is well known that a lot of the breakthrough innovation comes out of university research and small business. In the best world this grows into large companies or is merged with larger companies, leading to large scale commercialization. For this process to work successfully, it is critical that patent protection be effective. If the patent and courts systems are broken, there will not be a proper incentive for innovators, commercializers, or investors to proceed. Instead the coupon clippers will prevail.

As Randall Davis, MIT computer scientist put it during the first panel, "there is a lot of intellectual thrashing going on. There is a lot to computer software law that the court may not understand. It is time to expand the concept of computers and algorithms, which should not be tied to a physical machine." As Scott Alter put it, the Supreme Court has reached some novel decisions, and the "Circuit Court is reasoning too literally from out of date Supreme Court decisions simply to avoid being overturned." These are not decisions that necessarily have fundamental meaning in the long term. However, that does not mean that real decisions don't have real impacts on the parties involved in patent litigation.

In the following, much of the material is taken from the presentation of Jerry Riedinger of Perkins Cole. Keep in mind that although I have paid a lot of attention to legal matters since about 1984, I am not myself a lawyer, so any mistakes or misrepresentations are probably mine. If you are going to bet part or all of the farm, you should first consult a qualified lawyer.

This material is important because, to the extent that bad patents are reasonably invalidated, the entire system of intellectual property is strengthened, and innovation is encouraged. Further, to the extent that reasonable patents are invalidated using the increasingly strong tools to do so, much of the incentive to innovate for profit is eliminated.

One issue is combination patents in which a number of items of earlier art are assembled into a larger object or process for which the patent is sought. The watershed case in this domain is the Great Atlantic and Pacific Tea Company v. Supermarket Equipment Corp in 1950. The Court imposed the new idea that combinations are patentable "only when the whole in some way exceeds the sum of its parts." Related, "A patent for a combination which only unites old elements with no change in their respective functions ... obviously withdraws what is already known into the field of its monopoly." Now to the lay person, this makes a lot of sense, but it caused havoc in the legal system.

Thus, arguably, Congress passed the 1952 Patent Act, which in part tried to correct this Supreme Court decision. In a succession of additional decisions handed down Congress was essentially overruled by the court system, so that the A&P case continues to hold in modified version to this day. In Graham v. John Deere the courts found that "the revision was not intended by Congress to change the general level of patentable invention." In Anderson's-Black Rock the decision was that "A combination of elements may result in an effect greater than the sum of the several effects taken separately." In Sakraida the courts again found obviousness, because the invention "simply arranges old elements with each performing the same function it had been known to perform." Part of the problem here is that there is great ambiguity in the courts as to what constitutes an innovation that is sufficiently novel to produce this greater effect.

The political issue that leads to decisions tearing down issued patents is this. When a survey was performed to determine people's satisfaction with issued patents, the response was that 51% of those surveyed rated U.S. patent quality as "poor" or "less than satisfactory." (Of course the glass is also half full, but that is apparently not telling for the courts: 48.8% reported that issued patents were "satisfactory or "more than satisfactory." -- Interestingly, 0% reported that such patents were "outstanding." What does that say?)

My own questions about this would be the following. So what is surprising about half the people thinking that patents are OK and the other half thinking they are not? Half of the concerned people are patent holders, while the other half are in the position of needing a license. Why should what amounts to a perhaps biased interpretation of what is at best an informal survey (grousing and complaints as they are noticed) about an inherently political question lead the courts to tear down patents? Since when should the courts be run by complaints?

The history of cases yields a set of tools for invalidating patents. "Predictability" became a key test for determining whether a combination patent should be patentable. In KSR, "The combination of familiar elements according to known methods is likely to be obvious when it does no more than yield predictable results." Further, "If a person of ordinary skill can implement a predictable variation, section 103 likely bars its patentability."

Second, summary judgement which has historically been forbidden in patent litigation, has become accepted. In KSR again, "Where ... the content of the prior art, the scope of the patent claim, and the level of ordinary skill in the art are not in material dispute, and the obviousness of the claim is apparent in light of these factors, summary judgement is appropriate." This shockingly also places into the hands of a judge, who may have no technical skills and who may act alone, whether a patent involves obviousness.

As summarized by Jerry Riedinger of Perkins Cole, there appear to be four points in predicting obviousness:

More may be coming.

Boston. On Saturday, February 14 2009, afternoon panels led by Phil Swain and Marc Temin of Foley Hoag addressed new developments in the ways that patents can be invalidated. This represents an emerging critical dysfunction in the patent and litigation system. One speaker, Jerry Riedinger, likened recent developments re summary judgement in the case KSR International Co. v. Teleflex Inc. to the explosion of Mt. St. Helen. It was common knowledge that something was brewing, and then the mountain blew, creating a large, ugly hole. (Image from http://www.olywa.net/radu/valerie/StHelens.html.) The material addressed by

Boston. On Saturday, February 14 2009, afternoon panels led by Phil Swain and Marc Temin of Foley Hoag addressed new developments in the ways that patents can be invalidated. This represents an emerging critical dysfunction in the patent and litigation system. One speaker, Jerry Riedinger, likened recent developments re summary judgement in the case KSR International Co. v. Teleflex Inc. to the explosion of Mt. St. Helen. It was common knowledge that something was brewing, and then the mountain blew, creating a large, ugly hole. (Image from http://www.olywa.net/radu/valerie/StHelens.html.) The material addressed by  this panel is critically important for green-ness because the shift to the new ways will require an immense amount of innovation. It is well known that a lot of the breakthrough innovation comes out of university research and small business. In the best world this grows into large companies or is merged with larger companies, leading to large scale commercialization. For this process to work successfully, it is critical that patent protection be effective. If the patent and courts systems are broken, there will not be a proper incentive for innovators, commercializers, or investors to proceed. Instead the coupon clippers will prevail.

this panel is critically important for green-ness because the shift to the new ways will require an immense amount of innovation. It is well known that a lot of the breakthrough innovation comes out of university research and small business. In the best world this grows into large companies or is merged with larger companies, leading to large scale commercialization. For this process to work successfully, it is critical that patent protection be effective. If the patent and courts systems are broken, there will not be a proper incentive for innovators, commercializers, or investors to proceed. Instead the coupon clippers will prevail.As Randall Davis, MIT computer scientist put it during the first panel, "there is a lot of intellectual thrashing going on. There is a lot to computer software law that the court may not understand. It is time to expand the concept of computers and algorithms, which should not be tied to a physical machine." As Scott Alter put it, the Supreme Court has reached some novel decisions, and the "Circuit Court is reasoning too literally from out of date Supreme Court decisions simply to avoid being overturned." These are not decisions that necessarily have fundamental meaning in the long term. However, that does not mean that real decisions don't have real impacts on the parties involved in patent litigation.

In the following, much of the material is taken from the presentation of Jerry Riedinger of Perkins Cole. Keep in mind that although I have paid a lot of attention to legal matters since about 1984, I am not myself a lawyer, so any mistakes or misrepresentations are probably mine. If you are going to bet part or all of the farm, you should first consult a qualified lawyer.

This material is important because, to the extent that bad patents are reasonably invalidated, the entire system of intellectual property is strengthened, and innovation is encouraged. Further, to the extent that reasonable patents are invalidated using the increasingly strong tools to do so, much of the incentive to innovate for profit is eliminated.

One issue is combination patents in which a number of items of earlier art are assembled into a larger object or process for which the patent is sought. The watershed case in this domain is the Great Atlantic and Pacific Tea Company v. Supermarket Equipment Corp in 1950. The Court imposed the new idea that combinations are patentable "only when the whole in some way exceeds the sum of its parts." Related, "A patent for a combination which only unites old elements with no change in their respective functions ... obviously withdraws what is already known into the field of its monopoly." Now to the lay person, this makes a lot of sense, but it caused havoc in the legal system.

Thus, arguably, Congress passed the 1952 Patent Act, which in part tried to correct this Supreme Court decision. In a succession of additional decisions handed down Congress was essentially overruled by the court system, so that the A&P case continues to hold in modified version to this day. In Graham v. John Deere the courts found that "the revision was not intended by Congress to change the general level of patentable invention." In Anderson's-Black Rock the decision was that "A combination of elements may result in an effect greater than the sum of the several effects taken separately." In Sakraida the courts again found obviousness, because the invention "simply arranges old elements with each performing the same function it had been known to perform." Part of the problem here is that there is great ambiguity in the courts as to what constitutes an innovation that is sufficiently novel to produce this greater effect.

The political issue that leads to decisions tearing down issued patents is this. When a survey was performed to determine people's satisfaction with issued patents, the response was that 51% of those surveyed rated U.S. patent quality as "poor" or "less than satisfactory." (Of course the glass is also half full, but that is apparently not telling for the courts: 48.8% reported that issued patents were "satisfactory or "more than satisfactory." -- Interestingly, 0% reported that such patents were "outstanding." What does that say?)

My own questions about this would be the following. So what is surprising about half the people thinking that patents are OK and the other half thinking they are not? Half of the concerned people are patent holders, while the other half are in the position of needing a license. Why should what amounts to a perhaps biased interpretation of what is at best an informal survey (grousing and complaints as they are noticed) about an inherently political question lead the courts to tear down patents? Since when should the courts be run by complaints?

The history of cases yields a set of tools for invalidating patents. "Predictability" became a key test for determining whether a combination patent should be patentable. In KSR, "The combination of familiar elements according to known methods is likely to be obvious when it does no more than yield predictable results." Further, "If a person of ordinary skill can implement a predictable variation, section 103 likely bars its patentability."

Second, summary judgement which has historically been forbidden in patent litigation, has become accepted. In KSR again, "Where ... the content of the prior art, the scope of the patent claim, and the level of ordinary skill in the art are not in material dispute, and the obviousness of the claim is apparent in light of these factors, summary judgement is appropriate." This shockingly also places into the hands of a judge, who may have no technical skills and who may act alone, whether a patent involves obviousness.

As summarized by Jerry Riedinger of Perkins Cole, there appear to be four points in predicting obviousness:

- Is the invention understandable to lay people?

- Is the invention visually similar to prior art?

- Does a written explanation in the prior art seem to describe the invention?

- Do two out of three experts say the invention was predictable?

More may be coming.

Friday, February 6, 2009

Arch Coal at Harvard

In this post I am going to review some of the presentation of Steven Leer, CEO and Chairman of the Board at Arch Coal in St. Louis. First let me address a question that many have up front in relation to coal and coal mining. In response to a question from the audience, Steven stated that his company no longer does open-pit coal mining on mountains with drag lines in West Virginia, and they have left those old pits looking like rolling fields with grass. A later conversation with a colleague suggested that the hills might be heaps of "glop." The larger point however would be that Arch Coal by this account is quite different from many minerals companies that Jerrod Diamond describes as going bankrupt once they have extracted their riches, and leaving the cleanup to the local communities, the states, and the Federal government.

Although Leer's presentation focused on a justification for coal and carbon capture and sequestration (CCS) in our modern world, there was one key implicit point -- that it is critical to enable CCS. This might be seen purely as a self-serving argument for a coal company to make, since it would serve to extend the lifetime of coal in a world increasingly threatened by global warming. If I may draw an analogy to bridge, Leer's presentation within its own frame presents a strong argument for our society to continue to embrace coal as a fuel. It is available and cheap, and it is one of many fuel sources, none of which can supply the entire needs of our society. For some time the coal industry has been winning trick after trick within this suit. However, that argument is now being trumped by the limitations imposed by Mother Earth. One strand of thought among members of the audience was that the new trump suit would now take all the tricks, but there is yet another trump suit that may in certain situations trump the environmental limitations suit. That is the behavior of other nations. Internationally, Leer's argument is much stronger. The burgeoning use of coal by China and India itself provides a sufficient argument for giving a priority to CCS R&D. If we in the United States are capable of developing and perfecting CCS, then we can export it to other nations. If we simply allow other nations to implement coal, they will increase their carbon going into the atmosphere much faster than we could counterbalance that through any reductions we make in our carbon emissions ... and the ballgame is quickly over. This of course assumes that funding and research is not a zero-sum game. A possible next level of trumping would be the argument that clean coal is a boondoggle, an oxymoron, a distraction that steals valuable resources and commitments from implementing proven solutions such as wind energy. The next level of trumping, perhaps relevant more for a physicist such as myself than for most others, comes from Niels Bohr. Bohr embraced dilemnas, grinding the horns against each other to develop deeper understanding. In my current level of understanding, setting aside all the other issues,this is still useful in the energy and global warming domain. The nagging question, however, is "How long can we set aside the other issues?"

Now let's look at some of the slides and evaluate the degree to which we can agree with Leer's points. The first slide shows the growth of electrical demand over the past few decades. This is real. It also fits with the commonly accepted theory about the growth of electrical demand with the growth of the GDP. Some people talk as though electrical growth caused or at least enabled economic growth. However, looking at international figures such as those displayed in the second Arch graph, it is apparent that some nations are able to be vastly more efficient in their use of electricity relative to their standard of

The first slide shows the growth of electrical demand over the past few decades. This is real. It also fits with the commonly accepted theory about the growth of electrical demand with the growth of the GDP. Some people talk as though electrical growth caused or at least enabled economic growth. However, looking at international figures such as those displayed in the second Arch graph, it is apparent that some nations are able to be vastly more efficient in their use of electricity relative to their standard of  living. Some of the inefficiency of a nation such as Norway may be related climate or the degree of dispersal of the population. There are hints of it in Graph 1. One can see this in the downturns in electrical demand circa 1976 and circa 1983. The first may be a response to the energy crisis, the second the delayed results in the industrial sector to efficiency efforts. With the Reagan administration began a long period of encouragement of free use of electricity and fuels. The decreases indicate that our culture can make significant decreases in electrical use if we all choose to place our priorities in that direction. While this may seem arcane to policy makers, it is obvious to people who have done value engineering or energy conservation engineering in facilities or who have thought carefully about their own electrical consumption in homes and workplaces.

living. Some of the inefficiency of a nation such as Norway may be related climate or the degree of dispersal of the population. There are hints of it in Graph 1. One can see this in the downturns in electrical demand circa 1976 and circa 1983. The first may be a response to the energy crisis, the second the delayed results in the industrial sector to efficiency efforts. With the Reagan administration began a long period of encouragement of free use of electricity and fuels. The decreases indicate that our culture can make significant decreases in electrical use if we all choose to place our priorities in that direction. While this may seem arcane to policy makers, it is obvious to people who have done value engineering or energy conservation engineering in facilities or who have thought carefully about their own electrical consumption in homes and workplaces.

Thus it is no surprise to most people that electrical demand will be increasing dramatically over the next decades. This is only partly because of rising standards of living. It is also because of industrialization. As one historian commented, where the First Industrial Revolution was based on water power, the Second Industrial Revolution was based on electrical power.

The next figure shows why much of the new electrical generation will be coal fired. Coal is cheap if one does not take consideration of full life cycle costs including emissions that create global warming, if one does not accept that the earth is an increasingly finite system. Coal is also locally available in many key countries, including the United States, Europe, China, and India.

And the resulting increases in CO2 emissions will be dramatic. The only problem is that they cannot be alloowed to happen. If they happen the game is over. Thus, if the world economic system as we know it is not to be simply shut down within a few decades, it is critical that we achieve rapid worldwide adoption of CCS. This may involve giving away the technology to many other countries. Otherwise they will not be able to afford it, and the adoption will happen too slowly for our civilization to survive.

As an addendum, I am going to insert the numbers projected by ISO so that they can be compared with the reserve margins provided by Arch Coal.

Although Leer's presentation focused on a justification for coal and carbon capture and sequestration (CCS) in our modern world, there was one key implicit point -- that it is critical to enable CCS. This might be seen purely as a self-serving argument for a coal company to make, since it would serve to extend the lifetime of coal in a world increasingly threatened by global warming. If I may draw an analogy to bridge, Leer's presentation within its own frame presents a strong argument for our society to continue to embrace coal as a fuel. It is available and cheap, and it is one of many fuel sources, none of which can supply the entire needs of our society. For some time the coal industry has been winning trick after trick within this suit. However, that argument is now being trumped by the limitations imposed by Mother Earth. One strand of thought among members of the audience was that the new trump suit would now take all the tricks, but there is yet another trump suit that may in certain situations trump the environmental limitations suit. That is the behavior of other nations. Internationally, Leer's argument is much stronger. The burgeoning use of coal by China and India itself provides a sufficient argument for giving a priority to CCS R&D. If we in the United States are capable of developing and perfecting CCS, then we can export it to other nations. If we simply allow other nations to implement coal, they will increase their carbon going into the atmosphere much faster than we could counterbalance that through any reductions we make in our carbon emissions ... and the ballgame is quickly over. This of course assumes that funding and research is not a zero-sum game. A possible next level of trumping would be the argument that clean coal is a boondoggle, an oxymoron, a distraction that steals valuable resources and commitments from implementing proven solutions such as wind energy. The next level of trumping, perhaps relevant more for a physicist such as myself than for most others, comes from Niels Bohr. Bohr embraced dilemnas, grinding the horns against each other to develop deeper understanding. In my current level of understanding, setting aside all the other issues,this is still useful in the energy and global warming domain. The nagging question, however, is "How long can we set aside the other issues?"

Now let's look at some of the slides and evaluate the degree to which we can agree with Leer's points.

The first slide shows the growth of electrical demand over the past few decades. This is real. It also fits with the commonly accepted theory about the growth of electrical demand with the growth of the GDP. Some people talk as though electrical growth caused or at least enabled economic growth. However, looking at international figures such as those displayed in the second Arch graph, it is apparent that some nations are able to be vastly more efficient in their use of electricity relative to their standard of

The first slide shows the growth of electrical demand over the past few decades. This is real. It also fits with the commonly accepted theory about the growth of electrical demand with the growth of the GDP. Some people talk as though electrical growth caused or at least enabled economic growth. However, looking at international figures such as those displayed in the second Arch graph, it is apparent that some nations are able to be vastly more efficient in their use of electricity relative to their standard of  living. Some of the inefficiency of a nation such as Norway may be related climate or the degree of dispersal of the population. There are hints of it in Graph 1. One can see this in the downturns in electrical demand circa 1976 and circa 1983. The first may be a response to the energy crisis, the second the delayed results in the industrial sector to efficiency efforts. With the Reagan administration began a long period of encouragement of free use of electricity and fuels. The decreases indicate that our culture can make significant decreases in electrical use if we all choose to place our priorities in that direction. While this may seem arcane to policy makers, it is obvious to people who have done value engineering or energy conservation engineering in facilities or who have thought carefully about their own electrical consumption in homes and workplaces.

living. Some of the inefficiency of a nation such as Norway may be related climate or the degree of dispersal of the population. There are hints of it in Graph 1. One can see this in the downturns in electrical demand circa 1976 and circa 1983. The first may be a response to the energy crisis, the second the delayed results in the industrial sector to efficiency efforts. With the Reagan administration began a long period of encouragement of free use of electricity and fuels. The decreases indicate that our culture can make significant decreases in electrical use if we all choose to place our priorities in that direction. While this may seem arcane to policy makers, it is obvious to people who have done value engineering or energy conservation engineering in facilities or who have thought carefully about their own electrical consumption in homes and workplaces.

Thus it is no surprise to most people that electrical demand will be increasing dramatically over the next decades. This is only partly because of rising standards of living. It is also because of industrialization. As one historian commented, where the First Industrial Revolution was based on water power, the Second Industrial Revolution was based on electrical power.

The next figure shows why much of the new electrical generation will be coal fired. Coal is cheap if one does not take consideration of full life cycle costs including emissions that create global warming, if one does not accept that the earth is an increasingly finite system. Coal is also locally available in many key countries, including the United States, Europe, China, and India.

And the resulting increases in CO2 emissions will be dramatic. The only problem is that they cannot be alloowed to happen. If they happen the game is over. Thus, if the world economic system as we know it is not to be simply shut down within a few decades, it is critical that we achieve rapid worldwide adoption of CCS. This may involve giving away the technology to many other countries. Otherwise they will not be able to afford it, and the adoption will happen too slowly for our civilization to survive.

As an addendum, I am going to insert the numbers projected by ISO so that they can be compared with the reserve margins provided by Arch Coal.

Subscribe to:

Posts (Atom)